Outsourcing AP services improves cash flow and cuts workload for businesses. It saves time, cuts costs, and allows companies to emphasize growth.

According to Capactix, In 2023, the market valued AP outsourcing at USD 589.23 million and expects growth. By outsourcing accounts payable management, businesses can ensure timely payments. This approach also improves accuracy and helps build better vendor relationships. Additionally, it keeps financial records organized.

This blog will discuss what outsourcing AP is and what are its benefits.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing means hiring another company to manage payments and invoices for you. This helps reduce the workload for the business’s team. These providers have the skills and tools to improve accounts payable.

Accounts payable refers to temporary duties to suppliers. It is listed as a liability on a company’s financial statement. The best outsourcing partners handle these tasks in a better way. Some businesses with sensitive data prefer to handle payments themselves using automation.

According to Bloomberg, Baker Tilly is adapting to three significant changes. First, more customers are using online services. Second, people now value good service and strong relationships more than low prices. Finally, innovation means providing new and customized services to meet different needs.

Outsourcing is now seen as a smart strategy beyond saving money. With a rise in remote work, businesses use outsourcing to enhance efficiency and support growth. Acc. to the HBR, In 2022, 90% of small businesses in the U.S. planned to outsource tasks like tax, accounting, and human resources. They noticed that rather than focusing on expanding their business, they spend about seventy percent of their time on everyday chores.

The global subscription market will strike $1.5 trillion by 2025 as it is growing fast. Todd Bernhardt from Baker says outsourcing gives access to experts and advanced tools. He adds that this setup, through subscriptions, helps businesses save on costs. According to AICPA, Outsourcing accounting services for CPA firms will become a significant revenue source in the future.

As companies move through stages—startup, growth, maturity, transition, or exit—Baker customizes its services to their needs. Startups often handle essential tasks with a small team. Growing businesses face challenges in HR, taxes, and accounting. These challenges can lead to issues like payroll errors and financial mismanagement. Business owners should focus on their main activities. Baker will handle financial tasks and work with clients to support their goals.

Baker Advantage helps businesses grow with flexible, goal-focused services. They manage finance and accounting tasks, allowing owners to focus on strategy and growth. With a monthly subscription, Baker Advantage handles tax, accounting, and HR needs. They are also adding new tools to better support client success.

According to CNN, Businesses have long outsourced payroll and tax functions to save time and money. Now, some firms handle all financial tasks below the CFO level, cutting costs by 25 to 40 percent. The Internet now makes it easier for startups and small businesses to outsource more functions online.

For example, General Motors recently outsourced its financial operations in a $250 million deal. Additionally, new firms like LeapSource are growing by serving mid-sized businesses. Outsourcing is even developing, regardless of the challenges.

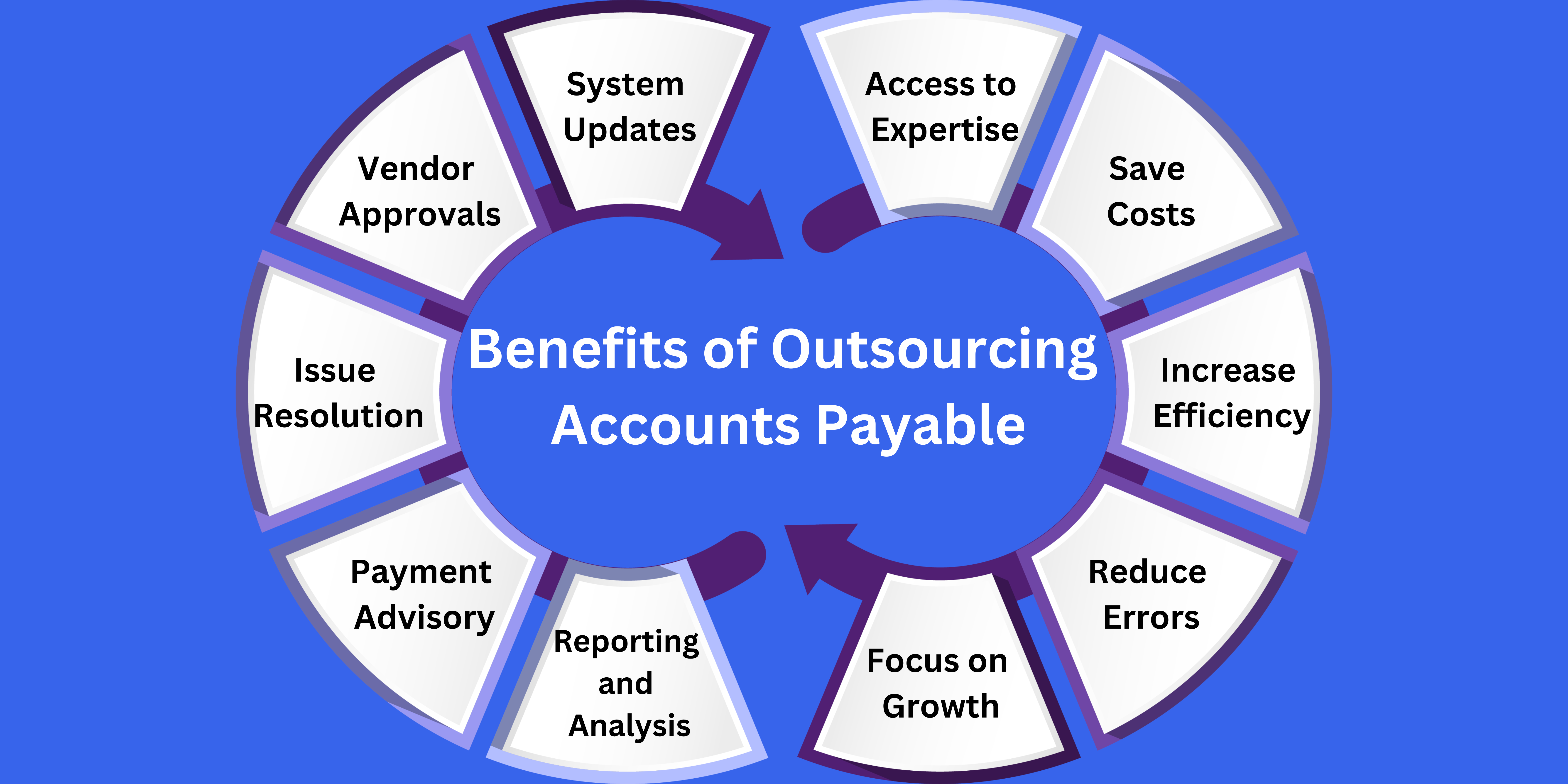

Benefits of Outsourcing Accounts Payable

Outsourcing accounts payable (AP) services have many benefits. It makes managing your finances easier and more efficient.

System Updates

With outsourced services, your accounting system gets automatic updates. This means sale orders, bills, and goods receipts are always up to date, giving you accurate financial data in real-time.

Vendor Approvals

Outsourced providers help manage vendor approvals by checking everything against sale orders. This keeps your business compliant and builds stronger relationships with vendors.

Issue Resolution

Experts handle issues like unauthorized purchases, missing goods, and invoice errors. This reduces mistakes and keeps operations running.

Payment Advisory

Outsourcing gives you access to expert advice on handling payments. Professionals help avoid early payments, secure discounts and set clear payment instructions. This helps you manage cash flow better.

Documentation and Reconciliation

Outsourced services include drafting important documents, such as credit and debit notes. They also keep vendor accounts accurate and reconcile them. This ensures that your financial records are transparent and correct.

Reporting and Analysis

You’ll receive precise reports on things like aging payables, outstanding orders, and unpaid invoices. These insights help you make informed purchasing decisions, budget, and spot vendor trends.

Focus on Growth

Outsourcing authorizes you to divert your focus back to growing your business. Handling accounts payable consumes resources and time. These resources could be better used for strategic tasks. For example, you could focus on expanding your market or improving customer relationships.

Reduce Errors

By outsourcing, you acquire credentials from experts who specialize in accounts payable with industry knowledge and experience. They use advanced tools to reduce errors like duplicate payments, missed invoices, or wrong entries. This keeps your financial management accurate and protects you from potential losses.

Increase Efficiency

Outsourced services streamline the entire accounts payable process. By automating tasks and speeding up invoice processing, they improve cash flow and ensure timely payments. This not only improves efficiency but also helps maintain good relationships with vendors.

Save Costs

Outsourcing can help save money by reducing costs associated with maintaining an in-house AP team. This contains salaries, technology, and training expenses. It also permits companies to take advantage of earlier payment deals and avoid late payment fines. Both actions further boost their financial position.

Access to Expertise

Outsourcing accounts payable gives you access to expert teams who stay updated on the latest changes in rules and best practices. This ensures that your AP function operates well and meets industry standards. It is particularly valuable for SMEs. These businesses might not have the budget to hire permanent financial professionals.

Drawbacks of Outsourcing Accounts Payable

Loss of Control

Outsourcing can help you control spending better. To keep things running well, stay in touch with your outsourcing partner and get regular updates.

Data Security Concerns

Sharing financial data with another company can raise security concerns. To protect your information, choose a provider that follows strict security guidelines.

Integration Challenges

Adding outsourced AP services to your current systems can be tricky and may cause temporary issues. Choose a provider experienced in smooth system integration to make the process easier.

Accounts Payable Outsourcing vs. Accounts Payable Automation

Accounts Payable Outsourcing

Outsourcing of accounts payable means that an External partner company handles everything for you. They use their tools to manage your bills and payments.

Before choosing a company, check their prices, services, security, and customer support. Ensure they manage payments on time and assist with cash flow.

Accounts Payable Automation

Instead of outsourcing, you can use AP automation software. This software works with your existing system to handle AP tasks.

AP automation software includes several key features. It provides a supplier portal for managing information and handles invoices online. The software also scans and stores documents. It detects fraud, automates approvals, and supports local and global payments. Additionally, it offers real-time payment reports.

Tips for Choosing the Right Accounts Payable Outsourcing Partner

Finding a suitable AP outsourcing provider is key to making progress. Here are simple tips to help you decide:

- Pick a provider with a good track record and experience in handling AP, especially in your industry.

- Make sure they use up-to-date tools like automation and have strong data security.

- The provider should be able to adapt to your needs and grow with your business.

- Choose a provider that covers all your AP needs, such as processing invoices and handling payments.

- Don’t look at the price. Consider how they can improve your efficiency and cash flow.

- They should be easy to talk to and provide good support. They should keep you informed and address any issues.

- Make sure they follow industry rules and standards, especially if you’re in a regulated industry.

Conclusion

Outsourcing accounts payable saves money, enriches operations, and sustains company objectives. By choosing the right provider, businesses can improve their accounts payable. Using the right technology also helps improve the process. Managing the outsourcing relationship well turns accounts payable into a competitive advantage.

To see how our AP outsourcing helps, schedule a call with Expertise Accelerated. We’ll work with you to create a strategy that meets your unique needs.